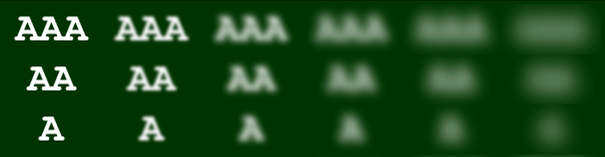

Similar to the visual acuity of the eye, rating systems also recognize patterns and contours with different accuracy.

You may have already experienced it with your ophthalmologist: An “8” is considered a “B”, a “c” is confused with an “e”, and so on. The resolution of the eyes is different. The same is true of rating models and methods of classifying the creditworthiness of economic units. Each rating also has the dimension of different evidence.

Maybe your rating was just turned on the wheel of fortune? It may happen to some debtors or disappointed investors. If there is no correlation at all between the rating given and the actual probability of default, the evidence of the rating would be zero, 0%. Only theoretically can the evidence reach 100% absolute judgmental certainty. An unplayed dice or a state-controlled, notarized lottery game gives examples of probability judgments that can be given with almost absolute certainty.

Another example: Your good gut feeling may allow you to assess tomorrow’s weather conditions. The evidence is low, but maybe you’re lucky and in line with your prognosis. However, the German Weather Service works according to the DWD law with more extensive resources and far-reaching responsibility for the meteorological security of maritime and aviation and official warning. Scientifically, these forecasts are based on higher evidence. What applies to the weather forecast applies in this sense for any kind of rating result. If you do not even use the thermometer and the barometer for the prediction, you often miss the prognosis.

Another example: An unzinked die rolls a one with a one-sixth chance. Thus, a rating system that assigns to this event exactly this probability of 16.6 …% and not erroneously a higher (e.g., 20%) or lower (e.g., 10%) probability is better justified by empirical facts.

In the case of credit rating, the more highly accurate information on default risk estimates can be made available, the more likely it is to provide a high quality, accurate rating. Numerous sources of information help to find a high-evidence rating. The rated company itself can play a key role in determining an accurate rating by providing you with well-known credit rating information and by explaining the extent of its involvement in the judgment of these institutions.

Understand the meaning of “rating evidence”.