Some surprising observations

Many Internet users do not bother to memorize the exact domain of a website, but simply enter a clear keyword into the Google search engine in order to be able to simply click on the desired result and visit the desired website. The displayed search results are therefore of great importance for the impression that a user receives from the respective rating agency.

As reported in an earlier post (“The Only Credit Rating Agency Recognized by BaFin“), an agency recognized by the European Securities and Markets Authority (ESMA) uses this function in order to present itself with a unique differentiating feature from all other agencies, namely with recognition by the German Federal Financial Supervisory Authority (BaFin). The catch is that BaFin has not been responsible for overseeing rating agencies for almost a decade, since 2012. Today, BaFin no longer gives its own recognition to rating agencies, which the rating agencies would allow to refer to in their advertising. The key to the rating business is the authorization according to the EU regulation.

Against the background of the ban on advertising with BaFin’s recognitions, the question arises of what significance the search results have in practice. How often could it happen that people are misled due to incorrect information in the search results? How often are rating agencies searched for that give false information?

Since search engines such as Google display their search results depending on the location, it must be taken into account that Google will most likely display rating agencies in the search results that are located in the vicinity or at least in the country of the searcher.

Only the following registered credit rating agencies are based in Germany:

| Name of Credit Rating Agency | Registered |

|---|---|

| Scope Hamburg GmbH (previously Euler Hermes Rating GmbH) | 2010 |

| Creditreform Rating AG | 2011 |

| Scope Ratings GmbH (previously Scope Ratings AG and PSR Rating GmbH) | 2011 |

| GBB-Rating Gesellschaft für Bonitätsbeurteilung GmbH | 2011 |

| ASSEKURATA Assekuranz Rating-Agentur GmbH | 2011 |

| Moody’s Deutschland GmbH | 2011 |

| Rating-Agentur Expert RA GmbH | 2015 |

| DBRS Ratings GmbH | 2018 |

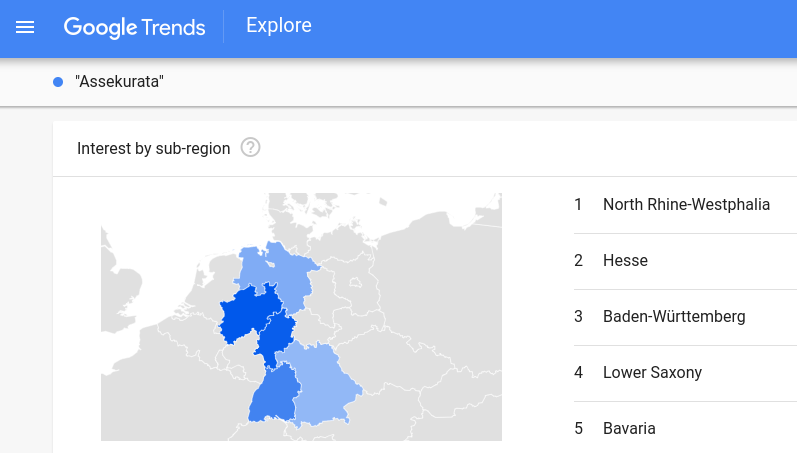

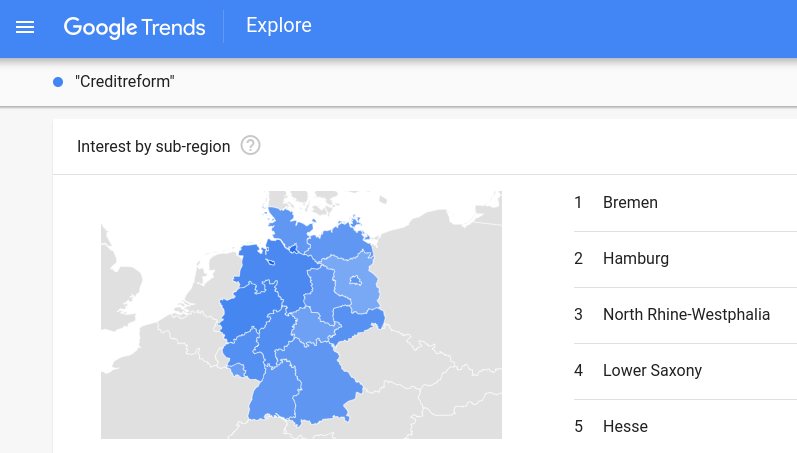

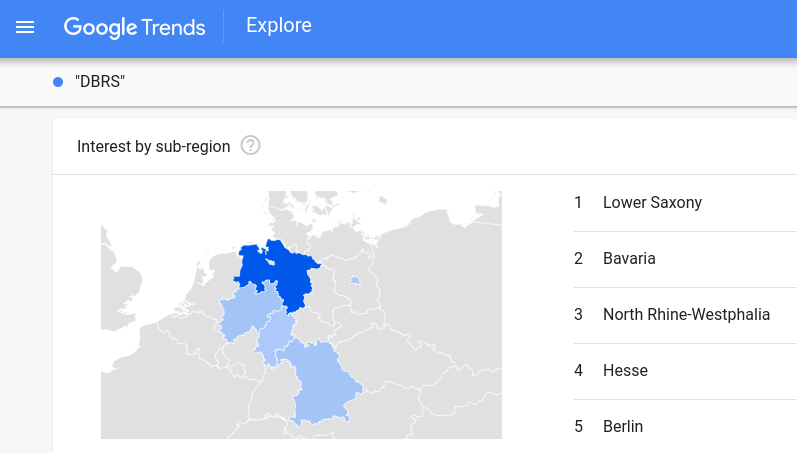

Further below are the results from Google Trends, shown by snippets of screenshots. The information was accessed on August 27, 2021 on Google Trends. For the assumptions, requirements and interpretation of these results, please refer to their website.

Google Trends provides access to a largely unfiltered sample of actual search requests made to Google. It’s anonymized (no one is personally identified), categorized (determining the topic for a search query) and aggregated (grouped together). This allows Google to display interest in a particular topic from around the globe or down to city-level geography.

Here are a few notes on the study design:

- The searches here were carried out with the shortest possible search term that unmistakably leads to the respective rating agency. For example, if you enter the word “Assekurata“, the rating agency you are looking for is already at the top of Google’s search results. “ASSEKURATA Assekuranz Rating-Agentur GmbH” is the correct full name of the agency. However, it can be assumed that most users do not bother to type in the full name including the legal form (“GmbH”), but are content with the word “Assekurata“. By the way, that is also the website’s domain name, https://www.assekurata.de/.

- Entering the word “Creditreform” does not land you directly on the website of the rating agency, “Creditreform Rating AG“, but on the website of the group of companies to which the agency belongs. In addition, there are no other confusing results among the first search results. All search results for the keyword Creditreform lead to the right group of companies.

- But if you search for the word “Scope”, you will likely get a translation of the word or a lexicon entry for “scope”. Who searches for this word “scope”, often searches for the following words as well, writes Google: Vortex, Scope statement, Zoom lens, C-Programming language, Carbon dioxide, and more. All of these search terms are not at all related to the EU-registered credit rating agencies in Berlin and Hamburg. Only those who want to be sure to find one of these rating agencies will find it under the following entries: “Scope Ratings” or “Scope Hamburg“. It is therefore imperative to add the word “Ratings” or, in the case of the Hamburg-based agency, to add the word “Hamburg”.

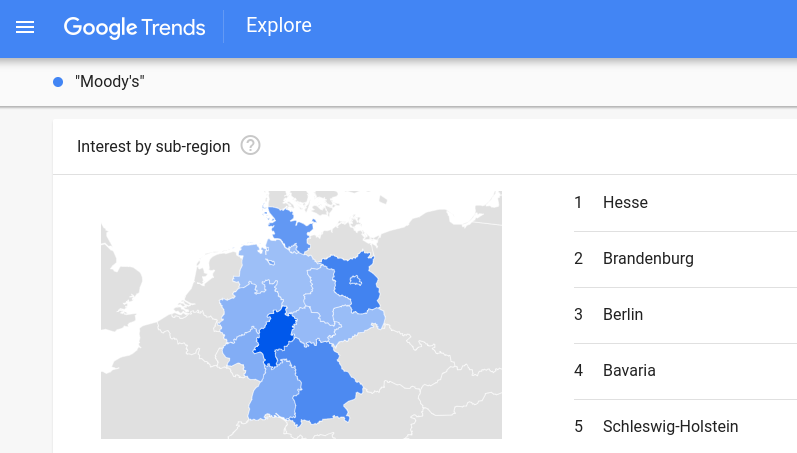

The more German federal states are marked in a shade of blue and the darker the blue, the more inquiries Google was able to record.

ASSEKURATA Assekuranz Rating-Agentur

Creditreform Rating

DBRS Ratings

GBB-Rating Gesellschaft für Bonitätsbeurteilung

Moody’s Deutschland

Rating-Agentur Expert RA

Subscribe to get access

Read more of this content when you subscribe today.

Interest in rating agencies from all over Germany

As the figures show, there is keen interest in most rating agencies domiciled in Germany. So these rating agencies are searched again and again: Assekurata, Creditreform, DBRS, and, last not least, Moody’s. It also shows that the important financial centers in Germany are obviously relevant for the number of searches for these agencies. The city of the headquarters of the rating agency also seems to play a role, as does the industry or international orientation.

It should be emphasized once again that the searches are only made for those agencies that are also based in Germany. Rating agencies such as S&P Global Ratings or Fitch Ratings, which also have offices in Germany, but rather have their registered company domiciled in another country, are not taken into account. This search restriction is not associated with any judgement of the services provided by these agencies, but serves better comparability of the search results.

On the basis of the evidence shown above, the following hypotheses could be discussed:

- Assekurata is based – and therefore searched there – at the insurance location Cologne, but is also wanted in the financial center of Frankfurt.

- Creditreform is sought after all over Germany, as the company group also enjoys a reputation as an information bureau or credit agency.

- In the case of DBRS, the connection to Morningstar and the fund rating might have led to a high number of searches.

- With its international reputation as a US market leader, Moody’s is sought in the internationally important financial centers of Germany.

Now, however, the question arises why there are not a lot of search queries to be observed with the other agencies that would allow Google Trends an overview of the whole of Germany with blue coloring. Why do these agencies find less interest? The following facts and assumptions can be put together for this purpose. However, these can only help to understand the results, but cannot replace more detailed investigations.

The financial services industry specialist

As an independent European rating agency, GBB-Rating offers clients a portfolio of services encompassing rating, risk analysis, scoring and benchmarking. GBB-Rating’s credit assessments focus on banks, building societies and leasing companies. GBB-Rating is a subsidiary of Prüfungsverband deutscher Banken e.V. (Auditing Association of German Banks).

As an independent credit rating agency registered with the European Securities and Markets Authority (ESMA), every year it analyzes the credit standing of private commercial banks in Germany and numerous European institutions. Since 2012 the ratings produced by GBB-Rating have been one of the factors used to calculate the contributions payable by the banks to Entschädigungseinrichtung deutscher Banken GmbH (EdB), the subsidiary of the Association of German Banks that guarantees savers’ deposits.

Most of the ratings from this agency are not published at all, but rather communicated directly to the banks assessed. The rating is primarily important for the relationship between banks and the deposit guarantee system.

The Compensation Scheme of German Private Banks (EdB) was entrusted by the German Federal Finance Ministry with the task of running the statutory deposit guarantee and investor compensation scheme for the private banks in Germany. The EdB’s job is to compensate the creditors of a bank assigned to it where the bank is unable to repay deposits. Liabilities arising from securities transactions conducted by a credit institution (i.e. bank) as defined in the EU Capital Requirements Regulation (CRR) are also deemed to be deposits.

Comparatively few experts are concerned with these very special questions. They are also supplied directly by the rating agency via distribution lists. An explanation for the low search volume on Google might be sought in these circumstances.

The continental specialist with roots in Russia

Rating-Agentur Expert RA GmbH is the legal entity of RAEX-Europe, affiliated with the international group RAEX. The group has more than 20 years of experience in rating and analytical industry. RAEX-Europe assigns classic credit ratings according to the international scale as well as non-credit ESG ratings (environmental, social & governance). In December 2018 together with the leading Chinese rating agency CCXI, the Pakistani VIS Group and the Islamic rating agency IIRA, RAEX-Europe signed a memorandum dedicated to the preparation and publication of analytical products for the Silk Road countries.

The agency doesn’t even run a German website. Their orientation is international and the domiciliation in Germany is a decision for Germany as a location in the European Union, since EU-registered rating agencies must have a seat in the European Union. The services of this rating agency are aimed at a special professional audience such as those with interests in the post-Soviet states.

The all-rounder with a claim to market leadership

Subscribe to get access

Read more of this content when you subscribe today.

Leave a comment