Rework requested

Just a few years ago, a cereal was linguistically associated with Kellogg’s. Anyone who spoke of Kellogg’s in Germany thought of cornflakes and vice versa, anyone who thought of cornflakes would also think of Kellogg’s.

In the meantime, discount chains – from Germany for example – such as Aldi and Lidl have revolutionized the world of brands. Lidl in particular attacked the big brand names directly in a spectacular advertising campaign. In 2016, Lidl began to directly compare famous branded products with its own brands and explicitly give the customer the choice of choosing the more expensive branded product or a much cheaper comparable product. The customers have made the choice, some branded products are still around today, others have completely disappeared from the shelves.

Perhaps unnoticed by many, a brand name that had been known for decades in almost every American household and even worldwide – at least among bond issuers and professional investors – disappeared. The curious thing about this story is that the brand is still being talked about even though it no longer exists. Anyone looking for this company has to use an intelligent search engine that remembers the story and therefore directs to the right page. If you search under the old name among the official registrations, you will no longer find what you are looking for. The valuable brand name appears in a footnote at best.

For the company of a rating agency, the most valuable thing is its history. The ability to correctly forecast the solvency of companies and other bond issuers can only be demonstrated over a long period of time. Trust in a rating agency develops very slowly; in the case of the leading agencies, it developed over a century. Trust in the rating agency is inextricably linked to its name. Analysts and computer models can also be quickly bought by other agencies and put on the greenfield. However, the history and corporate culture of a credit rating agency cannot simply be reproduced and is therefore a valuable asset.

For supervisory authorities such as the European Securities and Markets Authority (ESMA) as well as for the European Central Bank (ECB), the history of a rating agency is of decisive importance for the recognition, be it as a registered or a certified credit rating agency. Renaming in the agency does not play a role for the purely legal recognition. However, expectations of market participants and users of credit ratings are associated with the age of the name.

If a rating agency abandons its name, it can continue to protect the abandoned trademark if necessary. From a purely legal point of view, the old brand name may still be protected, but economically it has been given away.

2016 was also a memorable year for the US rating agency Standard & Poor’s

Standard & Poor’s Corporation was an internationally known credit rating agency. It was created in 1941 from the merger of the American companies H.V. & H.W. Poor Co. and Standard Statistics Bureau. As an abbreviation, S&P quickly caught on. Until the 1970s, the agency’s business activities could be compared to a publishing house rather than to the research and credit departments of banks.

In the 1990s, almost all of the agency’s products were also offered on paper and not primarily electronically. A parent company like McGraw-Hill, which is itself a publishing group, fits such a “publishing company”. McGraw-Hill was an American publisher founded in 1909 and based in New York City, known for textbooks and school books and financial information services.

In 1959 they had sales of $ 100 million. In 1961 they took over F. W. Dodge Corporation (which had its focus on the construction industry) and in 1963 the Webster Publishing Company, with which they entered the market for textbooks for elementary schools and high schools, which they expanded in 1965 with the takeover of the California Test Bureau. With the takeover of Shepherd’s Citations in 1966, they moved into the field of legal books and with the takeover of Standard & Poor’s in the same year in the field of financial information services. In 2011 it was split into S&P Global and McGraw-Hill Education (taken over by Apollo Global Management in 2012).

5 years after the break-up of the group, the famous brand name finally came to an end. S&P Global had hired a global brand transformation company to develop a unified branding strategy: Landor, founded in 1941 by Walter Landor, who pioneered some research, design, and consulting methods that the branding industry still uses. Landor has also advised Coca-Cola and Kellogs.

Landor belongs to the WPP group of companies: WPP plc is a British multinational communications, advertising, public relations, technology, and commerce holding company headquartered in London, England. WPP’s brand consultancies Landor and FITCH have now grouped under one entity named “Landor & FITCH”. Since January 2019, FITCH has been part of the Landor family under new stewardship. FITCH should not be confused with rating agency Fitch Ratings.

While the consultancy itself kept its 1940s name, they recommended Standard & Poor’s to abandon the 1940s name. Landor was founded 1941, Standard & Poor’s formed in 1941. In 2016, the year in which the discounters started their massive attacks on the established brand names, the brand name Standard & Poor’s was abandoned, while Landor continued to use his famous name. The renaming took place at a time when the defense of brand names was particularly important.

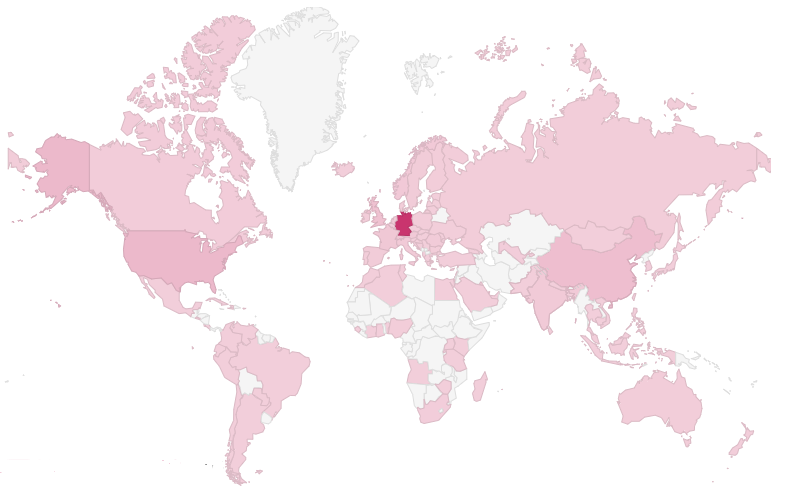

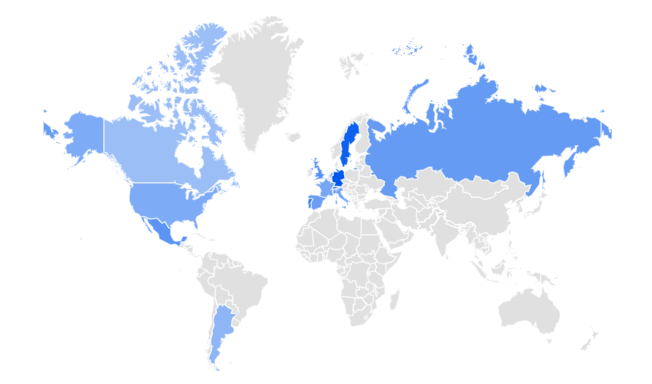

The addition “global” is particularly old-fashioned and out of date: As early as the turn of the millennium, the internet economy made it clear that practically every company can claim to be globally active. Even the information that is held by the smallest companies is accessed worldwide, as the example of RATING EVIDENCE GmbH from Frankfurt am Main, Germany, shows. The map traces the countries from which the website was able to record visitors (as of September 4, 2021):

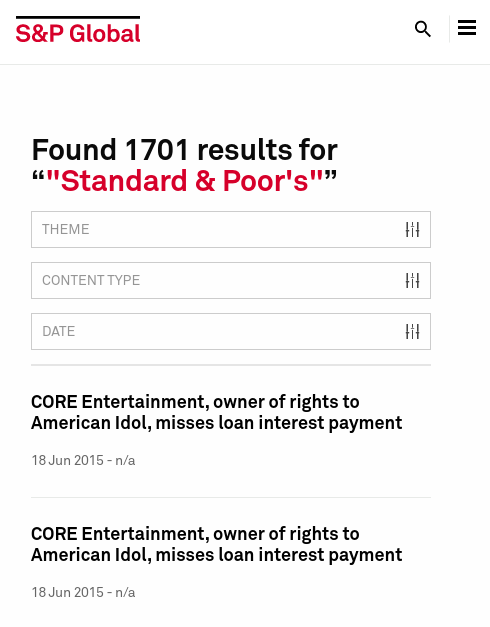

As the following retrieval from September 4, 2021 shows, the name “Standard & Poor’s” can no longer be found on the agency’s website itself in all documents since 2016. If you search for the old company name, you will find documents from 2015 or older:

The famous name of the rating agency is no longer written out anywhere. If the old documents are deleted one day, the name will even disappear entirely from their own website. Anyone looking for the name “Standard & Poor’s” will one day no longer find what they are looking for at the agency.

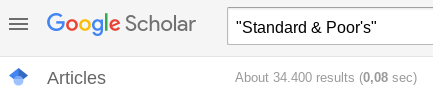

Although the internet has grown exponentially in the last 5 years and the number of information offers and bloggers has increased significantly, there are still many more sites that speak of “Standard & Poor’s” and not of “S&P Global Ratings”.

An estimate of how many pages the term “S&P Global Ratings” is used on can be determined using the Google search engine. In terms of search results, it must be taken into account that tens of thousands of pages have already been published by the rating agency itself and may be part of these search results.

Despite the dramatic growth of the Internet in the last few years, there are still more pages quoting “Standard & Poor’s” than “S&P Global Ratings”. Anyone who thinks that these are just old pages that have not yet been updated can be convinced of the opposite:

The agency is also still listed under its old name in the popular Internet reference works:

Google Scholar provides a simple way to broadly search for scholarly literature. Search across a wide variety of disciplines and sources: articles, theses, books and so on. Students and scientists from all over the world use this database. Here, too, it becomes very clear how the attempt to establish the new brand name has failed:

Standard & Poor’s is one of the few companies that has made a name for itself in school textbooks. Anyone who studies investment and finance at one of the business schools will sooner or later hear from the credit rating agencies and, among them, in particular from the two market leaders Moody’s Investors Service and Standard & Poor’s. In the United States, the CFA Institute is one of the most important educational institutions beyond the business schools. The CFA Institute plays a role similar to that of the German Association for Financial Analysis and Asset Management in Germany. The CFA Institute is a leading organization for the investment profession globally by promoting the highest standards of ethics, education, and professional excellence for the ultimate benefit of society. There can hardly be a greater honor for a rating agency than being a name that is part of the examination knowledge for professionals, the knowledge relevant to the exam for professional competence.

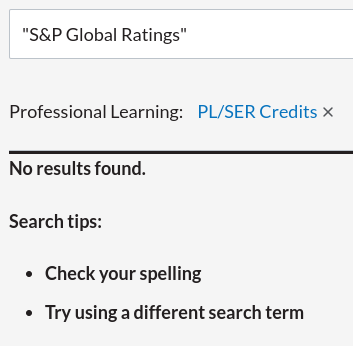

Even this important institution did not get the name change. All documents on the website can only be found under the old name “Standard & Poor’s”, but not under the new name “S&P Global Ratings”:

All of this leads to a sober balance: the rebranding has not been successful in the last 5 years. As has already been shown earlier, there is no mention of the new name even in specialist circles. For companies like Apple or Coca-Cola it is clear that the brand name is a valuable part of the company.

Who would think of renaming Coca-Cola to “CC Global Drink”?

The following world map of “Google Trends” shows in which countries Standard and Poor’s was searched for for the last 12 months up to September 4, 2021. Such a map can only be displayed on Google Trends if a sufficiently high number of search queries have been registered. The world map speaks a clear language, because it shows that many Internet users still make the effort to type in the long company name “Standard & Poor’s” into the search engine in order to find the rating agency. Judging by the number of search queries, the renaming does not seem to have arrived in these countries in particular: Germany, Sweden, Portugal, Switzerland, and United Kingdom.

A famous and traditional brand name became a senseless combination of letters and words. If the name “Standard & Poor’s” is no longer used anywhere and is not cultivated as a brand, it is completely forgotten where the name came from. With the renaming without history, the memories of the story also end. In this credit rating business in particular, it is all about showing off many years of experience and expertise.

The credit rating agencies have gone through many ups and downs over the decades of their activity. In the dot-com bubble, promises made by companies that promised new markets and “a new economy” were lightly believed. In the global financial crises, rating agencies were blamed for overly optimistic ratings. All of these events left deep wounds that have long healed. Hence there is no need to give up a good name for a “letter salad”.

With the keywords: “Would you like your ratings poor, standard or OK?” Willem Okkerse went on business trips about the risks of AEX listed companies. Even these puns by the deceased rating expert could do no harm in the brand name.

The rating agency “Standard & Poor’s” had demonstrated that it could learn from mistakes and draw conclusions. The undesirable developments were cracked down on. The rating agencies were subjected to even stricter regulation in the USA and comprehensive legal control in Europe. Laws have also been passed in Africa and Asia which give rating agencies a special status in many countries.

The services of a rating agency are not like an app from an “AppStore” that was only invented a few years ago, in 2007. In the dynamic environment of apps and webs, name changes may correspond to changed user needs in quick succession. The strength of the leading agencies lies in the fact that they have used comparable rating symbols and scales for decades, which promise comparability and continuity. The renaming of the agency did not reflect the nature of the agency’s activities.

“Four businesses unite as one financial powerhouse“: The renaming appears to follow from a disregard for the meaning of names. A name always stands for visions and demands on the future. If you chop up the name beyond recognition, you also violate the identity of the company. The names “S&P Global Market Intelligence”, “S&P Global Ratings”, “S&P Dow Jones Indices” and “S&P Global Platts” suggest a comparability of the diverse activities, which is not given in reality. On the one hand there are companies that provide factual market information, on the other hand there is a rating agency that draws up analysts’ opinions.

Again questions arise about the brand names

Recent corporate development events raise the question of how the corporate group’s branding should be structured. The experiences from the unsuccessful relaunch of 2016 must be taken into account. Brand names alone can be worth billions. To destroy a brand name means to destroy value for the owners. The owners of the brand names do not sit in the consulting firms, but in the general meetings of the shareholders.

Subscribe to get access

Read more of this content when you subscribe today.

Leave a comment